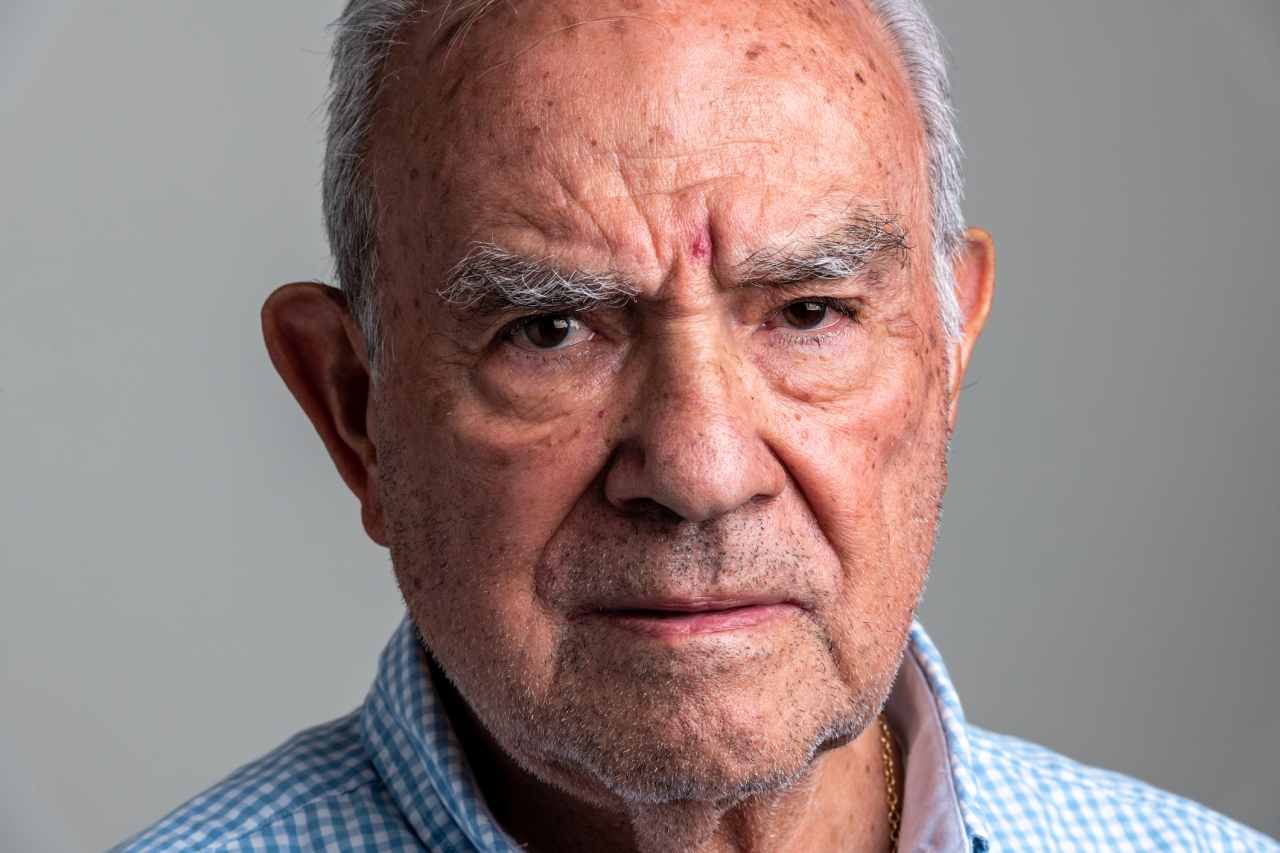

‘The selling agent is long dead’: My $250,000 term life-insurance policy costs $2,000 a month. I’m 80. Is it time to ditch it?

Please enable JS and disable any ad blocker

Information contained on this page is provided by an independent third-party content provider. This website make no warranties or representations in connection therewith. If you are affiliated with this page and would like it removed please contact editor @producerpress.com